Over half of Irish households cannot save income regularly, according to new report

By Erin Lindsay

04th Mar 2020

04th Mar 2020

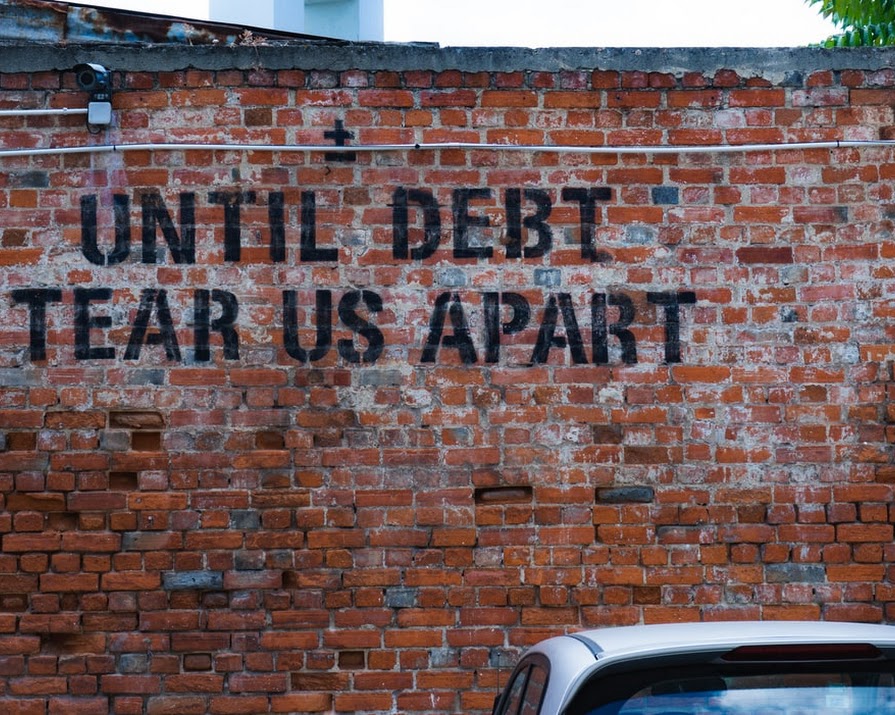

The report by Tasc challenges the idea that people get into debt because of a “personal failing”.

Over half of Irish households cannot save income regularly, with that figure rising to 77% for low-income households, according to a new report.

Tasc (the Think Tank for Action on Social Change) issued new research that details the effect that the burden of debt has on Irish households.

Over one in three renters in the private sector who are in debt are overburdened by debt repayments. Those renting in the private sector are nearly four times more likely to go without heat due to lack of money than those who own their own homes.

Tasc is calling for the government to give more consideration to debt as a factor in housing, health and other service reforms. According to their research, a significant number of working households are both “struggling” and “squeezed” due to debt repayments. One in five workers with debt are struggling with repayments and nearly 50% of all workers are at risk of becoming over-indebted in the future.

Single parent-households are at particular risk of becoming overindebted, with 36.3% of single-parent households with debt are overburdened by debt repayments.

Not a personal failing

Tasc mentions in their report that getting into debt is often seen as a “personal failing or problem… in both policy and practice”, but according to their research, this is not the case. Tasc said: “household debt in Ireland is directly connected to the rising cost of living and lack of affordable housing, as well as access to financial services and income levels.”

The report concludes with a personal account of the impact debt can have on a worker in Ireland, from Mary, a MABS (the State’s money advice service) in Donegal:

I was drowning in debt… You’re sitting up with the [Bank] with a begging bowl in your hand, hoping they’ll give you three months moratorium, or six months moratorium… only for MABS I can’t even imagine where I would be. I wouldn’t even want to think about that.”

Read more: Feeling the pinch? Try our 30-day money-saving challenge

Read more: ‘I paid off €15,027 of debt in one year. This is how I did it’

Read more: The best Instagram accounts to follow to help you save money