By Edaein OConnell

10th Apr 2019

10th Apr 2019

I have friends who have bought houses; are looking at houses; thinking about houses; talk about houses and finally, hate the faint whisper of houses. I fall into the last category.

I’m in my early twenties, fresh out of an education bubble and equal parts frightened and excited for what this life has in its arsenal for me. My friends and I like a random midweek drink, cappuccinos and eggs Benedict. If we could somehow find a way to live sustainably on French toast, we most certainly would. Saving doesn’t particularly bother us on a day-to-day basis, but every once in a while, we hear the mutterings of expanding rent prices and we all shudder. Suddenly, we think about credit ratings and pensions and week-long holidays to Trabolgan with our imaginary gaggle of children.

The prices in Dublin alone are now 30% higher than in Celtic Tiger times when they all thought it would last forever and the economy would never stop booming and the whole country would eventually be made of gold. We all know the end to that novella, and this won’t continue either, but until then: what do we do?

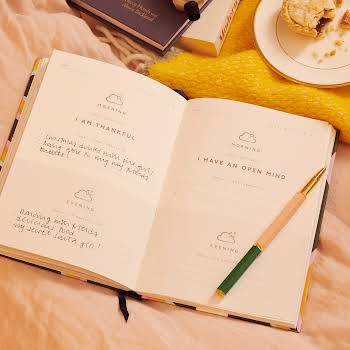

Should we be saving for our future or living our lives as a twenty-somethings?

Our parents have a knack of looking at our habits with unabashed judgement. By their mid-twenties, many of them had their own houses, savings accounts and some small ounce of predictability for their future. I like the idea of saving for the mortgage for the hypothetical house of my dreams, but I am also partial to the idea of packing up, ridding myself of responsibilities, seeing Thailand and beyond, living solely on rice and only then coming home to face my responsibilities.

Long-term thinking

However, there is a niggling sense among us that maybe we need to begin thinking long-term about our lives. There is always room for error in a burgeoning economic situation and we can never fully trust a growing GDP. When that thundercloud of obligation rolls in, will it be too late for us? They keep shouting that the millennials and Gen-Z may never be able to own their own houses- so are we doomed to rent forever with no life being lived in between? At 25, we should be paying into our pension fund. When you happen upon someone that you might like to share a life with, the automatic neurological response isn’t to love – it’s to save for a mortgage deposit.

At the crux of it, we are scared. Just like every other person in their early to mid-twenties was in generations before us. The difference is that we like to delay life’s duties and only become adults when we hit 30.

The saving/living life debate is very introspective. It’s personal and at the end of the day, no one can make that decision but you. Some are more inclined to life on the road, and more than willing to leave worries behind than others. Many more are anxious about their futures and a feeling of security to them is essential. There should not be an innate pressure coming from both sides; one telling us to live and the other telling us to get a grip. People have been doing both for years and businesses still run, houses are still bought and lives still develop.

Not travelling and deciding to save isn’t any less of a life and deciding to explore the world doesn’t mean you are foolish. They are separate entities with happiness, fulfilment and experiences found in both, but in different ways.

Those life choices will be made in good time when a person is ready, not when the world is roaring at them to panic that they aren’t doing enough now.

Breathe, relax, take your time. But there’s never anything wrong with putting a fiver away for a rainy day.

You know, just in case.

More like this: